Consumer choice division:

Change you can believe in

By David P. Hamilton / The Rag Blog / April 4, 2012

I could no longer tolerate the bell chamber of American cable news. Its obsessive fixation on the still months-away American presidential election pitting two candidates approved by the 1% was driving me up the wall. I would regurgitate involuntarily if forced to watch one more of that repulsive manifestation of all the worst features of America, the Republican primary debates.

So, I dumped Time Warner for the Dish to get access to better news sources. The Dish gets us Al Jazeera, Democracy Now, and RT (Russia Today -- media home of numerous American leftists), Link TV, Free Speech TV, and several other international sources of information. What a relief. Now I had a much wider selection of biases. But there remain issues.

This enhanced news selection prominently includes the various shows of Thom Hartmann, most notably, the “Big Picture” that appears on both RT and Free Speech. He also does a couple of hours of live call-in, just him talking and answering calls on camera.

Thom is very busy and generally very sharp. We are fortunate that he is there. Sometimes he does a feature where he debates two rightists at the same time. They are perpetually on the defensive. We first caught his show on San Francisco’s cable television. Then we found a way to get him in Austin.

After watching a few days and getting a bit excited, I called Thom's show and asked the following question:

Thom, you support a constitutional amendment to take corporate money out of politics and revoke corporate personhood. So do I. But to enact a constitutional amendment, it must be passed by two-thirds of the members of the Congress and then in three-fourths of the state legislatures.

If our democracy is already seriously corrupted by corporate money, how can we expect legislators who are already largely sycophants of corporate America, to act against the interests of those who pay so handsomely for their services by voting for this amendment?

Thom’s answer, confirmed by his Washington reporter guest, was that they have heard many legislators say that they really hate having to raise money all the time. If only enough of the electorate pressured them, they would vote for the amendment. They essentially argued that these are good people who just need a little support in order to do the right thing.

Basically, I asked Thom whether or not democracy was already dead in America and Thom answered by saying no, just on life support.

As much as I admire Thom, there is some fuzzy thinking here. He is campaigning hard for an amendment that is premised on the idea that democracy in America is quite seriously compromised already. Yet he appeals to the corrupted institution to rise up and cleanse itself. You can’t have it both ways.

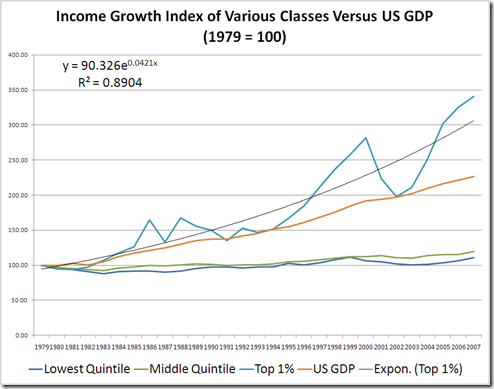

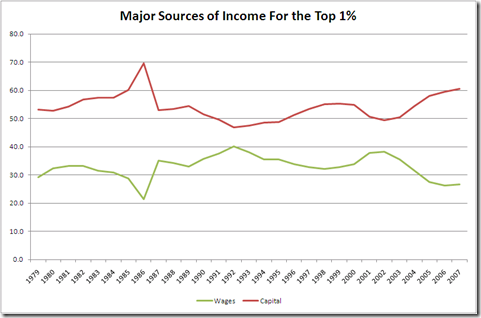

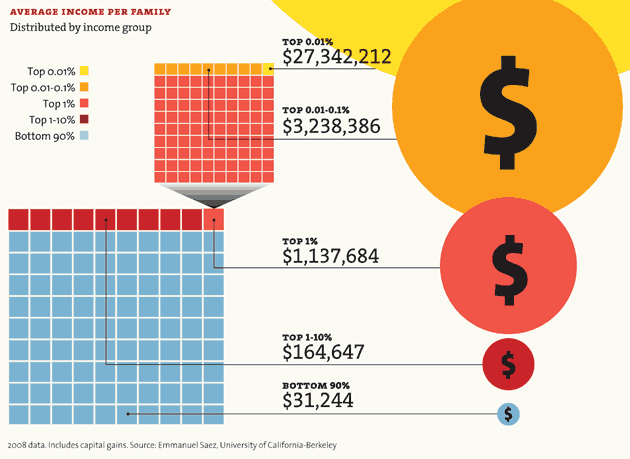

You can hardly expect the utmost beneficiaries of the burgeoning economic inequality that so heavily compromises our democracy to instruct their functionaries in the so-called “public” sector to rectify the situation in our favor.

Most legislators are already virtual employees of the less than 1%, the capitalist class who own the controlling interests in the major corporations. They are in that role because they are highly adapted to the corrupted system. They like money and power, the respectful recognition and bounteous benefits they acquire by being political operatives of the rich and powerful.

Thom’s answer posits that they are actually there to do what's best for the country and the general population and are only inhibited from doing so by the need to raise millions to run their necessarily expensive campaigns, money readily supplied by the dastardly corporations. That's nonsense. If that were true, they would have passed public financing of political campaigns years ago.

The amendment to overturn “Citizens United” may be a wonderful device to focus the public on the issue of how economic inequality corrupts our democracy, but it will pass when pigs fly.

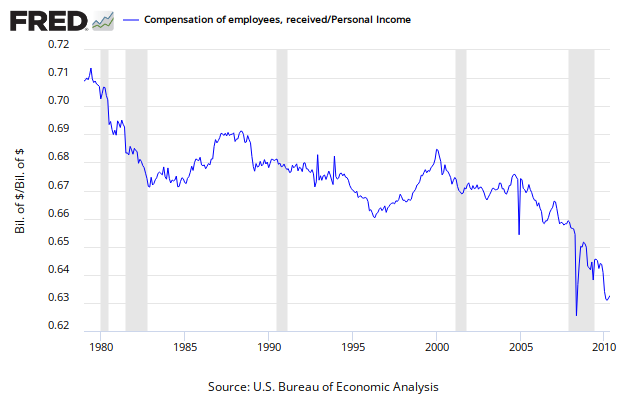

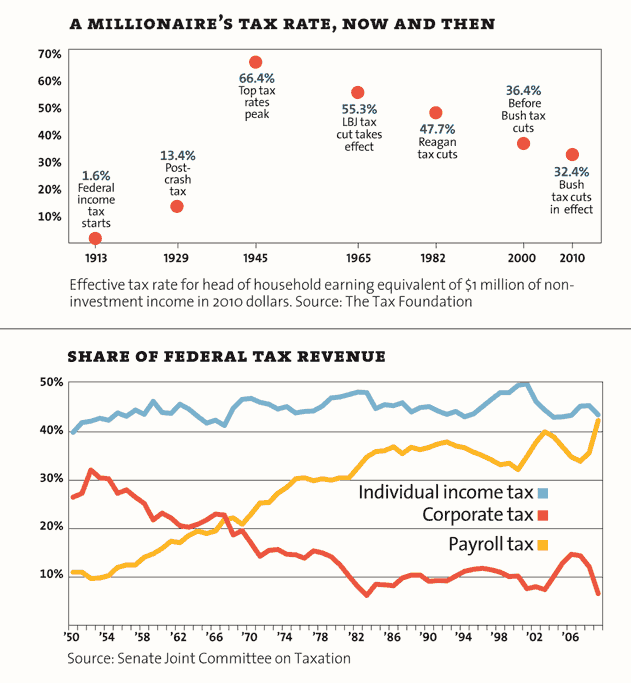

Which brings us to a fundamental question. Is economic reform that measurably effects income distribution in the U.S., and consequently the class structure, still possible given the current level of political corruption by corporate money?

The answer is not very possible, if at all, and the potential is diminishing. The ruling economic elite can only be expected to instruct their political servants to minimize their social responsibilities as much as possible and to increase their access to government money. They have unswerving faith in a religion called the "Free Market” -- and Social Darwinism that allows them to take this course without the least guilt.

What is the difference in corporate deference between Democrats and Republicans? The former have progressive voting constituencies that must be placated to some small degree, but just enough to distinguish them from Republicans.

The most crucial arena is the tax structure. Specifically, will the Democrats end the Bush tax cuts for the rich when they again have the chance? Despite the fact they controlled both houses of Congress and the presidency for two years, they did not do so when it was last up for a vote. Will they risk bing labeled as those who raised taxes or will they again “bargain it away”? I advise you to limit your expectations.

Before the “Citizens United” decision, the barriers limiting corporate control of the political process were already full of holes. With that decision, they fell by the wayside entirely.

As a direct result, we today have the spectacle of a Las Vegas gambling tycoon openly giving $15 million to Newt Gingrich to run his campaign. Given the donor’s reputed wealth of many billions, that’s pocket change. That example is just the egregious tip of the iceberg. It would be hard to argue that most legislators are not already at this point, beneficiaries of significant corporate largesse.

This system, like others, produces politicians that are adaptive to it. Insofar as there are still shining examples of probity in regards to corporate cash, given this burst of judicial activism by the Supremes, they are a dying breed.

Witness the strenuous effort that has been exerted for years to get rid of Congressman Lloyd Doggett of Austin. Eventually, his right-wing detractors will find the right district, the right flunky, and enough big bucks to take him down.

Their personhood is immoral, devious, relentless, and infinitely well financed. Corporations will continue to own the controlling interest in an enterprise known as the U.S. government and they will expand their holdings, because there is nothing to stop them and very little chance that things will change.

Consider also the important role the federal government now plays in relation to the private sector. Forbes magazine recently reported that of the 10 richest counties in the U.S., half of them bordered on Washington, D.C. Average household income in these counties hovers around $100,000 per year.

In recent decades northern Virginia has become an economic dynamo, driven by a private sector that feasts on government contracting. These counties are also home to corporate lobbyists, lawyers and consultants who work in or around the nation's capital, soaking up federal government spending.

There is no other prize more valuable to corporate elites than maintaining their control over the power and wealth of the federal government for their private gain. They are firmly in the driver’s seat now and have the power to change the rules to their further advantage. No election occurring in other than catastrophic conditions will change that and in such conditions, they probably won’t allow elections.

As American anarchist Emma Goodman once said, "If you could change things by voting, it would be illegal."

Whatever may have been the case in the past, serious reform that alters the class structure or the political institutions of American society in favor of the 99% is no longer possible by electoral means.

[Rag Blog contributor David P. Hamilton has been a political activist in Austin since the late 1960s when he worked with SDS and wrote forThe Rag, Austin's underground newspaper. Read more articles by David P. Hamilton on The Rag Blog.]